If there is a gap, something will fill it. This principle is also true in the world of business. Some brokers do not stand up to competition even after many years of operation. Some simply change their market orientation. And in the face of these changes, new brokers and trading platforms emerge. Recently, there has been increasing interest in the new broker https://www.investago.com/, and probably for good reason. As always, we have tried to make an objective analysis of a new broker’s performance as a user. And just from the user’s point of view to understand how reliable and profitable this broker is. But first things first.

Table of Contents

List of Content

Investago Licensing and Regulation

First, let’s look at the benefits of trading with a regulated broker. Regulated brokers must follow a set of rules designed to protect investors’ assets. This is the main reason why regulation is so important. Every regulated broker is subject to a “net capital rule” that prescribes a minimum amount of capital that must be maintained in liquid form. In this way, investors are protected by a ‘safety net’ in the event that a broker is forced to close. In addition to the minimum capital maintenance requirement, regulated brokers in most jurisdictions are required to keep all client funds segregated in separate accounts so that client funds are not accidentally (or intentionally) used for reasons other than to execute client trades. Some jurisdictions, such as the UK, even offer government-backed deposit insurance for their regulated brokers, so that clients can recover some or all of their funds even if the broker manages to misappropriate them.

In the case of InvestaGo, the broker is regulated by the Cyprus Securities Commission (CySec). Information about the license is also provided on the broker’s official website. The existence of strong regulatory bodies such as CySec is necessary in order to keep market abuse and money laundering to a minimum. Investors and traders can have full confidence in CySEC-regulated firms as they offer protection and security. CySEC, the Cypriot securities regulator, regulates the financial sector. Its aim is to guarantee the protection of traders through effective supervision.

Investago – Investment instruments

Let’s take a closer look at why this broker might be interesting for us from a business point of view. Although the broker is only in the first stages of its activity, it already boasts a good portfolio of trading instruments. In the top right corner of the website you will find a menu button and a Go Trading section. Once you click on this button, you can access the complete portfolio.

You could say that this is a classic brokerage series. However, rest assured that in the near future this broker will bring more and more options to traders. But that’s not all. Once you click on forex or commodities, for example, you will be redirected to another page with a brief explanation of what the page is about.

You may ask what it’s for. The broker and the creators of the site have thought about newcomers to the market and have placed this feature on their site just for them. So it’s sort of a little informative reminder of what this option entails.

We think it will be useful to examine each of the trading tools offered by InvestaGo in more depth. So let’s get to it:

- Foreign exchange trading, better known as Forex or FX, refers to the buying and selling of currencies in order to profit from changes in their value. Since forex is by far the largest market in the world, larger than the stock market or any other market, there is a high degree of liquidity. This market attracts many traders, both beginners and more experienced.

- Commodity trading dates back to antiquity; the rise of many empires can be directly linked to their ability to create complex barter systems and facilitate the exchange of commodities. In the most basic sense, commodities are known as risky investments because their market (supply and demand) is greatly affected by uncertainties that are difficult or impossible to predict, such as unusual weather fluctuations, epidemics and disasters caused by both natural and man-made forces. For investors, commodities can be an important way to diversify a portfolio beyond traditional securities. There are a number of ways to invest in commodities, such as futures contracts, options and exchange-traded funds (ETFs), giving investors options to choose what kind of risk they want to take and how they want to take it.

- A stock market index, also known as a stock index, measures a portion of the stock market. In other words, the index measures the change in the stock prices of different companies. A stock index is determined by calculating the prices of certain stocks (usually a weighted average). It is a tool widely used by financial institutions and investors to compare the returns of specific investments and to describe the market.

- A share represents a unit of ownership interest in a company. Shareholders are entitled to receive the profits earned by the company in the form of dividends. They are also the bearers of any losses the company may suffer. In simple terms, if you are a shareholder of a company, you hold a percentage ownership of the issuing company in proportion to the shares purchased.

After familiarizing himself with the information, the trader can start working immediately, or he can launch the great “Demo” button. And you can read more about this in the next paragraph.

Demo account

The demo account button is hidden between pages. On the home page you only have the option to log in or register, but there is no mention of a demo. However, once you decide exactly what you want to trade and go to the tools page, voila.

For example, if you want to try a stock, go to the stock page and a demo account option will appear at the bottom.

You will then go through the standard registration process. Judging by the fact that there is no information on how long the demo account is valid for, it is assumed that it is open-ended, just like a trading account.

A few seconds later you will receive a confirmation link in your email and you can test your trading skills. So what are the main advantages of a demo trading account? One of the most important advantages is the fact that you can get some practice without losing your hard-earned money. Similar to fun games on gambling sites, a demo account allows you to trade effectively, but you don’t make or lose money. It’s just a very good way to get a feel for this type of trading so you can see if it suits you, if you are proficient at it and if you enjoy it before you commit to trading with real money. It’s a perfect way to learn more about this type of trading and see if it’s the right choice for you, rather than jumping in headfirst and losing money only to find that it doesn’t appeal to you.

Business account

As far as the trading account is concerned, it’s business as usual. On the home page, you select the Register option and fill in your details. By the way, the registration form for the demo and trading account is exactly the same.

With just a few clicks of the mouse, you can use the services on the website and multiply your experience and capital. Another good bonus is that the broker does not charge any account fees. However, if you do not use your account for a month, Investago broker reserves the right to charge you €100 for account failure. However, we recommend trying out the trading account after using the demo account. This will help you develop your trading skills and feel more comfortable trading, and also balance your knowledge. Since InvestaGo is a broker that cares about educating its traders, you will find a real trading educational treasure on the website, which we will tell you about in the next part of our review.

Investago Education

Let’s start with an intimidating, albeit very real, truth: trading hasn’t become such a lucrative business because it’s a simple practice. While the concept itself is easy to understand, the millions of intricacies involved in smart and successful trades are not something that can be picked up haphazardly. Most traders are losing money. So if you are thinking of getting started, you must realize that it is very difficult.

Trading is also not a matter where there is such a thing as “the only right way”. The best way to approach it as a novice, or even as an experienced trader looking to hone your skills, is to absorb the research and within that research listen to a few expert opinions.

On the InvestGo broker’s website, you have a fantastic opportunity to expand your trading knowledge with innovative materials.

Guide for new traders

In this section you will find a large and useful collection of tutorials on various business situations or cases that may arise. Just select the section you are interested in, click on it and you will automatically see detailed information including examples. The broker offers this option completely automatically, and of course, there are many hours of hard work behind this step, but InvestaGo deserves a big plus for it. Not every broker has such a feature. It should be emphasized that this collection of tutorials is updated regularly. All the information is prepared by professionals and not amateurs from the world of trading.

Quiz to test your knowledge

Yes, yes, you read that correctly. The creators of the InvestaGo broker have made a unique marketing move by giving you the opportunity to take a trading quiz right on the website to confirm your trading skills.

It’s really a rare idea among brokers to give traders such an option. It can be a challenge for newbies and a fun diversion for experienced traders. When it comes to trading, determining what type of trader you are will help you determine what types of trading strategies you will use and how often you will use them. If you are a beginner, you may think you don’t know enough about trading to determine what type of trader you are. But don’t worry – there are people who have been trading for years, but even if you held them to the fire, they’d be hard pressed to give you a definitive answer. Either way, we encourage you to take the time to take this quiz. The results may surprise you, or they may delight you – you’ll find out for yourself.

Investago TV – video content for traders

If reading is not your preferred way of getting information, you can follow them. Broker InvestaGo produces great video content dedicated to trading. This is a weekly roundup of economic, business and world financial news. The videos are in English, so there is no language barrier for Czech traders. It’s a really convenient way of receiving information and watching the news. Imagine enjoying your morning cup of coffee and expanding your financial knowledge by watching a useful video.

InvestaGo website interface

The broker’s official website is still in the development stage, but already contains a lot of information. An example is the Market News section. This means that you will not only find trading options on the site, but also a source of useful information from the financial world. Real traders should appreciate this.

The website and its content create a sense of transparency and clarity in the broker’s activities. The interface is designed in white-black-red colours. The website provides detailed information on what documents are required to verify a trader, trading conditions and contact details. There is no chatbot. However, there are email addresses and phone numbers for contacting operators. Support is available 24/5 and you will get a response fairly quickly.

The InvestaGo trading platform is really client-friendly. However, let’s take a look at what the trading platform is from a technical point of view.

- A trading platform is a software system used to trade securities. It allows investors to open, close and manage market positions online through a financial intermediary such as an online broker.

- Key features of a good trading platform:

- Trading platforms are software systems used to execute and manage market positions.

- Trading platforms may offer an easy-to-use interface with basic order entry screens for novice investors.

- They may also offer more sophisticated tools such as real-time streaming quotes, advanced charting tools, live news feeds, educational resources and access to proprietary research.

- Traders and investors should consider fees and features when comparing trading platforms.

All of the above points can be observed at the broker InvestaGo.

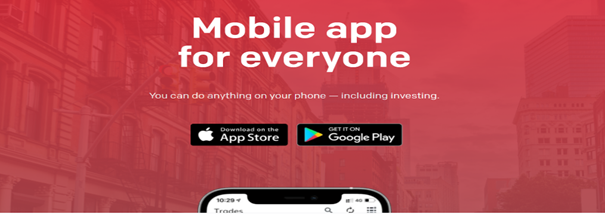

Investago mobile app

Nowadays, almost every brokerage firm offers its own app for online trading. The growth of mobile apps is undeniable and unstoppable. Some apps are even attempting to integrate artificial intelligence and various new features are being added to these apps. Due to its efficiency, ease of use, flexibility, security and greater accessibility, mobile trading has become the preferred choice for many.

Investago is no exception and also offers a mobile version of its website.

It’s hard to imagine a broker without a mobile app, as this way of using the site is very flexible, especially nowadays. You can download it by clicking on the InvestaGo suite on the AppStore or Google Play.

We can’t leave out the key benefits of mobile business apps, which include:

- Easy to use: mobile trading apps make entering orders quick and effortless. The ease of use is much greater compared to desktop terminals.

- Live portfolio overview and market updates: With the mobile trading app, you can view market data such as stocks, commodities, stock indices, etc. anytime on the go. You can also track your portfolio, its underlying assets and its performance to date.

- Notification feature: one of the winning features of market trading apps is the notification feature. No matter where you are, the app will send you alerts to inform you about the latest happenings in your portfolio as well as broker recommendations.

- Related news updates: In online trading apps, users can also follow live updates on developments related to a particular stock or segment.

- Research reports: trading apps also offer information from experts or brokerage firms in the form of up-to-date research reports.

- Analysis and charts: In case traders choose to trade securities, they can choose from a variety of trading apps: One of the most useful features of trading apps are historical charts and analysis option that allow to look into past data on indices, stock prices and provide analytical tools to do so.

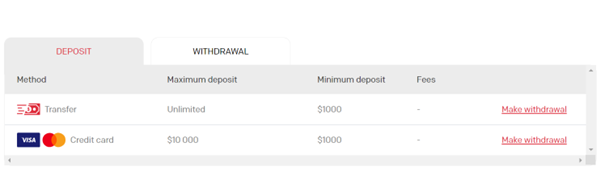

Payment and withdrawal options

There are many different payment methods available when trading online – different brokers support different deposit and withdrawal options. All trading payment methods also have different advantages and disadvantages related to fees, processing times and limits.

For some merchants, the time it takes to process a payment is crucial, while other merchants don’t mind waiting a few days. Similarly, depending on whether you make many small transactions or fewer larger ones, transaction costs may be more or less important.

When it comes to deposit and withdrawal options at InvestaGo, the broker has a lot to do. Although the classic options are already available – bank transfer or card payment:

- A bank transfer, also known as an electronic transfer, is a way of transferring money from one account to another. Individuals can make payments domestically or internationally, which means it is suitable for many merchants. Wire transfer also has strict rules, so it is considered safe for depositing large amounts of money;

- Upon entering the card payment page, the merchant is prompted to enter credit/debit card details (credit card number, name on card, expiry date, CVV/CVC) into the relevant payment form, after which the transaction is processed and either approved and cleared immediately or declined. Some brokers have attempted to increase the security of this process by allowing the option of storing the merchant’s card details so that they do not have to enter them into the payment form each time.

Anyway, the minimum deposit is quite high compared to other traders. According to some sources, it seems that the amount of min deposit will change once more payment methods are added and the amount becomes more flexible.

And a few words in conclusion

This is a new broker to the market and we have tried to be objective and fair in our review. There is no limit to perfection and it is good when a broker does not stop at the level achieved. We can observe the growing potential and increasing interest from traders. We want to highlight the broker’s all-round list of benefits. Some of the pros include the following:

- license availability

- demo account with unlimited time limit

- solid trading portfolio

- technical support phone numbers

- training materials

- Global market news section

Since the broker has another job to do and there is no limit to perfection, here are some disadvantages:

- limited list of payment method

- high minimum deposit

- no chatbot

From a user and trader perspective, this is a broker worth working with. We will keep an eye on what is new with the broker and keep you informed.

New broker – new experience.

To conclude our InvestaGo review, we want to share with you some information on how to get started and not get lost in the world of trading. If you are thinking of trading for the first time or returning to it after a break, here are some tips to follow.

1. Have a reason to trade

There are many reasons why people go into trading. But if your main motive is to make a quick buck, you might want to think again. Many people don’t realize how much time and work it takes to achieve success. However, if you are interested in the financial markets and would like to learn new skills, trading could be right for you.

As we all know, trading is risky – and that’s what makes it so exciting. That’s why you not only have to be realistic about what you want out of it, but also determined and willing to learn.

2. Get to know the markets

Trading is not black and white and each trader approaches the financial markets in his own way. There are many decisions to make before you start trading and one of the most important is to choose the market you want to trade in.

3. Creating a financial strategy

If you want to succeed in anything, you are much more likely to succeed if you have a plan in place. In trading, it’s no different, which is why you need a solid financial strategy before you even start putting your own money in.

The world of trading is an exciting one and profits and losses can accumulate very quickly. This means that it can be difficult to rid trading of emotions, but it is essential to do everything you can to remain objective.

A financial strategy can help:

- Establish your risk level, goals and rules for entry and exit.

- Stick to them no matter what your heart tells you

4. Find a trading platform suitable for beginners

There are many trading platforms to choose from, but not all of them are designed to help new traders take their first important steps. When you’re starting out, the best platform will be one that is committed to continuing education and will support you every step of the way.

5. Exercise as long as it suits you

Try a free demo account. Put everything you’ve learned into practice and see how the platform works. It is a free and risk-free tool that will guide you step by step through the process of making a trade.

If you follow these tips, you will gain business advantages and succeed will be easier for you.

Our Rating

Informasi Ekonomi Terkini

Berita Forex Terupdate

stratégie forex gagnante, forex factory, forex, trading forex, seputar forex, forex trading, forex adalah, harga emas hari ini seputar forex, apa itu forex, broker forex terbaik, harga emas forex, forex factory calendar, seputar forex harga emas, harga emas hari ini forex, trading forex adalah, robot forex, apa itu trading forex, kalender forex, robot trading forex, forex calendar, forex trading adalah, harga emas seputar forex, daftar broker forex yang terdaftar di bappebti 2021, forex factory hari ini, broker forex, factory forex, seputar forex harga emas hari ini, harga emas dunia hari ini forex, cara trading forex, hot forex, pt smi forex, forex time converter, berita forex hari ini, berita forex, belajar trading forex, trading forex menurut islam, cyber future forex, rekomendasi vps forex indonesia 2022, harga emas forex hari ini, daftar broker forex penipu, xm forex, just forex, forex halal atau haram, aplikasi trading forex, forex news, forex indonesia, forex factory.com, belajar forex, forex peace army, calendar forex, trading, trading adalah, trading view, robot trading, trading forex, binomo-website/trading, apa itu trading, trading binomo, adopt me trading values, trading economics, binomo trading, forex trading, trading saham, quotex trading, belajar trading, aplikasi trading terbaik, trading crypto, binomo web trading, fahrenheit trading, arti trading, hukum trading dalam islam, kursus trading, aplikasi trading, robot trading fahrenheit, robot trading dna pro, fakar trading, fahrenheit robot trading, trading forex adalah, adopt me trading value, trading halal atau haram, atg trading, binomo investment com trading, view trading, doni salmanan trading, trading artinya, aplikasi trading terpercaya, cara trading, binomo com trading, trading quotex, apa itu trading forex, mt4 trading, robot trading forex, cara trading saham, forex trading adalah, belajar trading pemula, trading bitcoin, belajar trading binomo, fbs trading, robot trading yang terdaftar di ojk, octafx copy trading