Table of Contents

Oil (WTI, Brent Crude) Analysis

- OPEC’s demand forecast suggests tight oil market into year end

- Brent crude oil pulls back from resistance as bullish momentum subsides

- WTI crude oil tests trendline support on latest dip

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

OPEC’s Demand Forecasts Suggest Tight Oil Market into Year End

Yesterday OPEC released its monthly report where it revised global GDP growth for 2023 and 2024 to 2.7% and 2.6%, up 0.1% respectively from last month’s assessment. A better-than-expected GDP growth outlook bodes well for oil bulls as concerns over the global growth slowdown ease. US GDP surprised massively in July while today UK GDP also came out better-than-expected but remains at low levels.

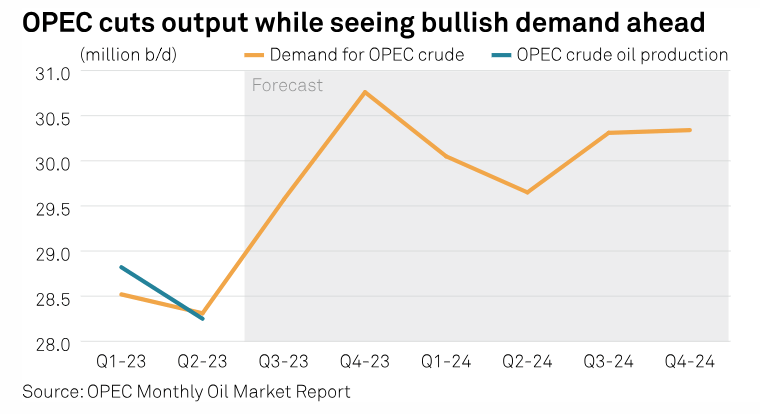

However, the demand/supply dynamic for OPEC’s oil suggests that oil prices are likely to remain high into year end. According to the latest report, OPEC retains its oil demand forecast which sees growth of 300,000 barrels per day (b/d) for Q2, 1.3 million b/d in Q3 and 2 million b/d for the fourth quarter. All figures are compared to the same periods in 2022.

OPEC’s 2024 demand estimates were revised 100,000 bpd lower to 30.1 million bpd, revealing a sizeable shortfall if supply were to remain around current levels (27.31 million b/d) according to secondary source estimates. Those same sources estimate July production volumes dropped 836,000 b/d from June as Saudi Arabia’s cuts took effect to.

Lower OPEC production is partially offset by record US production which is expected to rise 12.76 million bpd according to the Energy Information Administration. In addition, the International Energy Agency reports record global oil demand in June of 103 million b/d warning of inventory drawdowns into year end.

Source: OPEC, S&P Global, prepared by Richard Snow

Oil Pulls Back from Resistance as Bullish Momentum Subsides

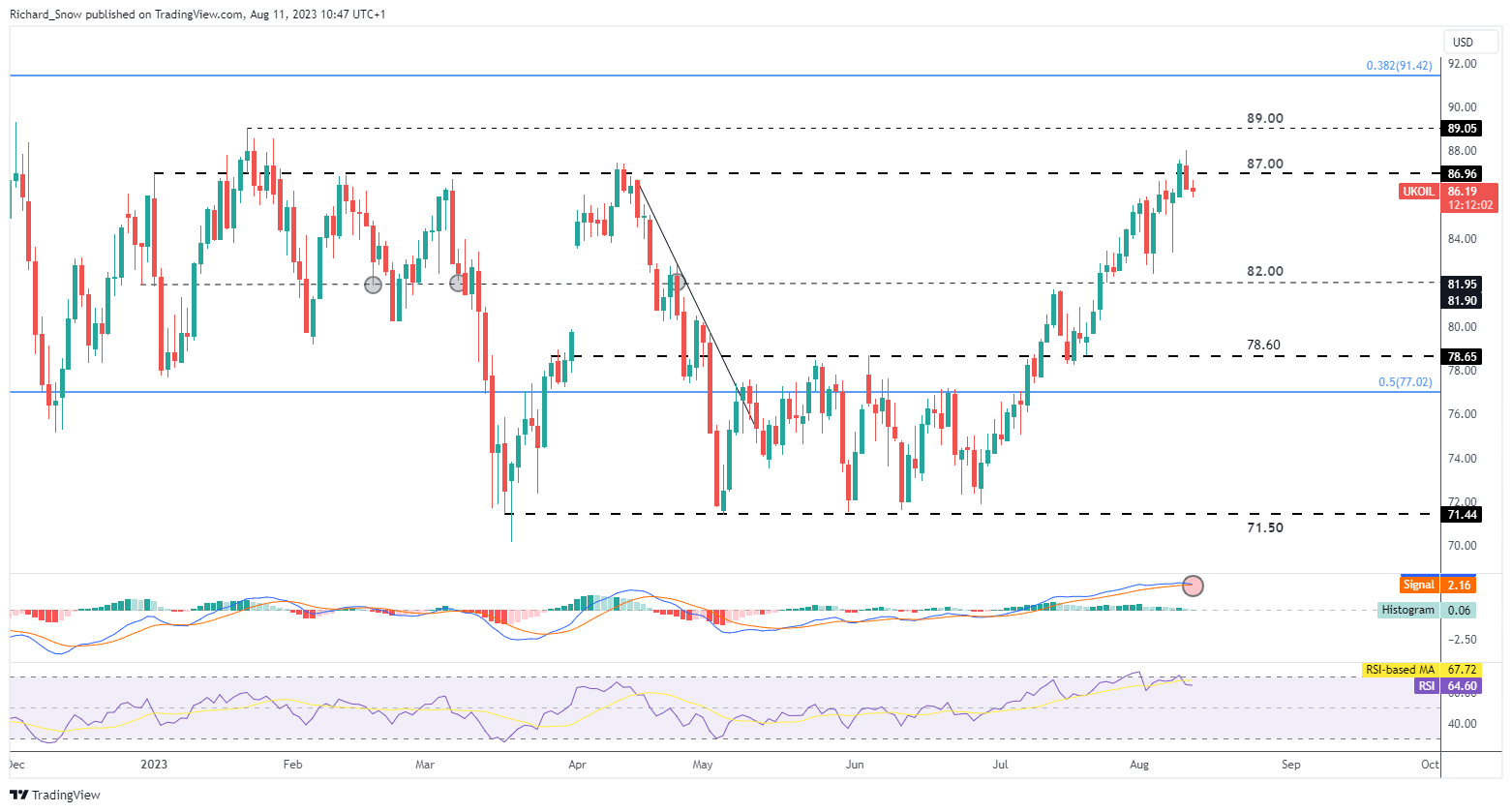

Brent crude oil prices traded up above $87.00 before pulling back yesterday. The MACD and signal line hint at a potential bearish crossover after an impressive ascent. The broader uptrend has been supported by Saudi Arabia’s voluntary 1 million bpd cut which is over and above the existing cuts agreed by the group with Russia also shaving around 500,000 bpd too.

With $87.00 a significant level previously, oil prices could consolidate here as the week draws to a close. Fundamental demand and supply factors point towards elevated prices into the end of the year. Possible pullbacks from here, bring $82 into focus.

Brent Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

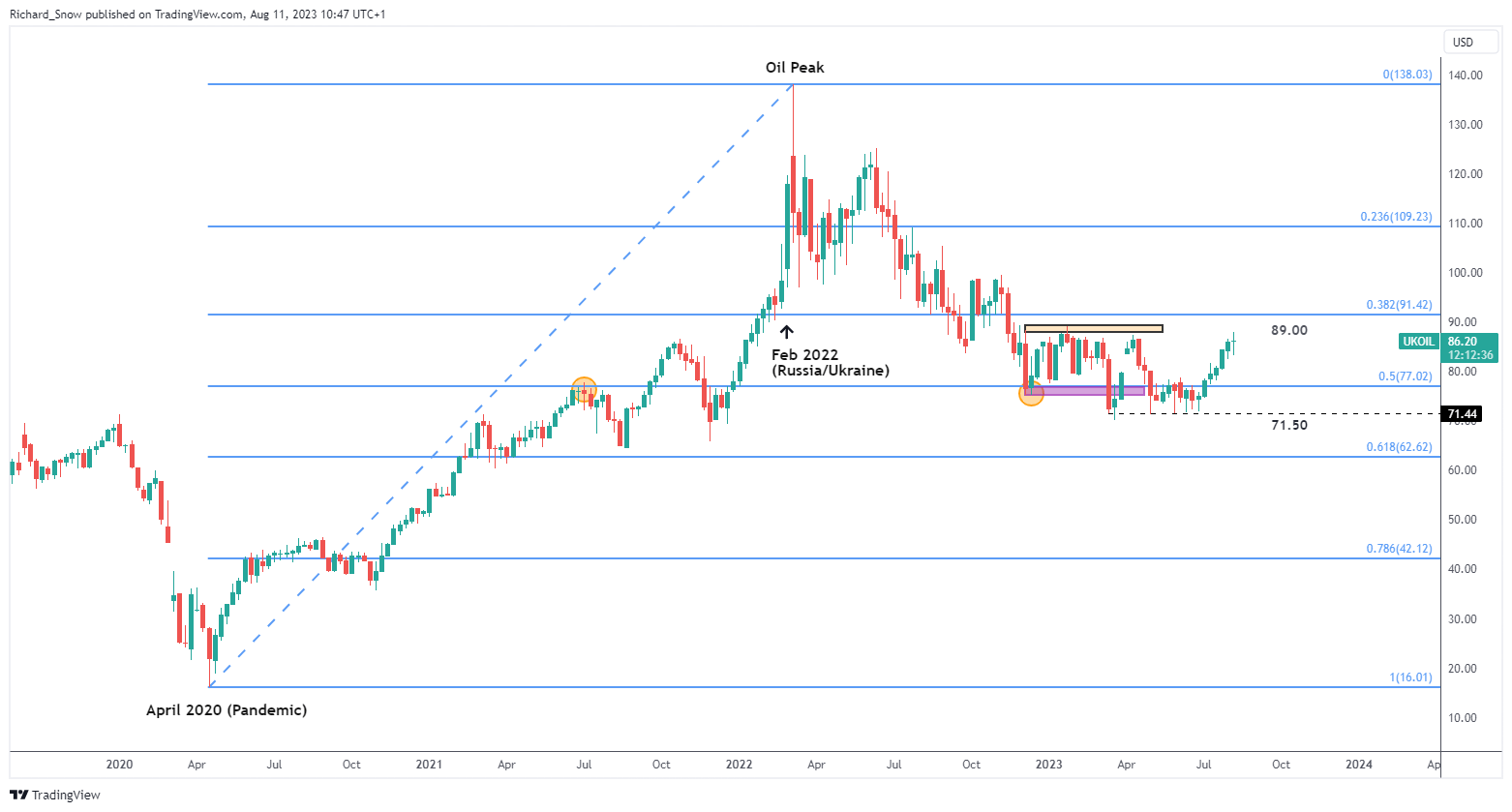

The weekly chart puts the recent bullish advance into perspective, rising from levels close to $70, now approaching $90. The 31.8% Fibonacci retracement at $91.42 hovers above the zone of resistance at $90, potentially halting bullish momentum for now. Prices are some way off the crisis Covid/Russia-Ukraine peak of $138 but given recent improvements in inflation, there is a strong incentive from US President Biden to keep oil prices at a respectable level.

Brent Crude Oil Weekly Chart

Source: TradingView, prepared by Richard Snow

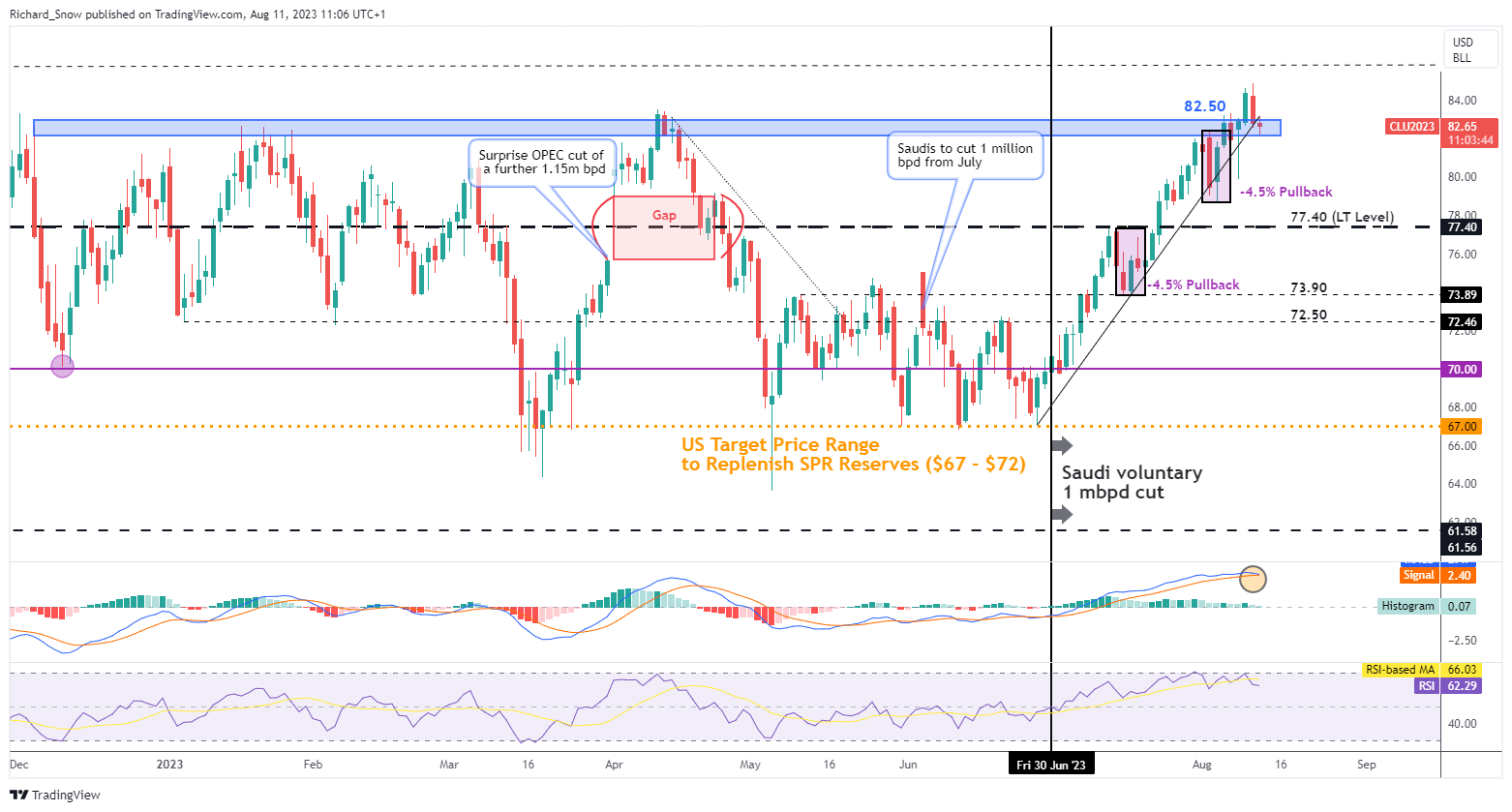

WTI Crude Oil Pulls Back to Trendline Support

WTI crude oil traded through $82.50 before heading lower yesterday. The steep slope of trendline support portrays the impressive rise of oil prices since July and now it comes under further scrutiny. Consolidation at this level appears likely heading into the weekend. A breakdown and close below the trendline and the zone of support opens up $77.40 as the next level of support. Resistance appears at $85.70. The MACD hints at a momentum slowdown.

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for nokturnal.com

Contact and follow Richard on Twitter: @RichardSnowFX

Informasi Ekonomi Terkini

Berita Forex Terupdate

stratégie forex gagnante, forex factory, forex, trading forex, seputar forex, forex trading, forex adalah, harga emas hari ini seputar forex, apa itu forex, broker forex terbaik, harga emas forex, forex factory calendar, seputar forex harga emas, harga emas hari ini forex, trading forex adalah, robot forex, apa itu trading forex, kalender forex, robot trading forex, forex calendar, forex trading adalah, harga emas seputar forex, daftar broker forex yang terdaftar di bappebti 2021, forex factory hari ini, broker forex, factory forex, seputar forex harga emas hari ini, harga emas dunia hari ini forex, cara trading forex, hot forex, pt smi forex, forex time converter, berita forex hari ini, berita forex, belajar trading forex, trading forex menurut islam, cyber future forex, rekomendasi vps forex indonesia 2022, harga emas forex hari ini, daftar broker forex penipu, xm forex, just forex, forex halal atau haram, aplikasi trading forex, forex news, forex indonesia, forex factory.com, belajar forex, forex peace army, calendar forex, trading, trading adalah, trading view, robot trading, trading forex, binomo-website/trading, apa itu trading, trading binomo, adopt me trading values, trading economics, binomo trading, forex trading, trading saham, quotex trading, belajar trading, aplikasi trading terbaik, trading crypto, binomo web trading, fahrenheit trading, arti trading, hukum trading dalam islam, kursus trading, aplikasi trading, robot trading fahrenheit, robot trading dna pro, fakar trading, fahrenheit robot trading, trading forex adalah, adopt me trading value, trading halal atau haram, atg trading, binomo investment com trading, view trading, doni salmanan trading, trading artinya, aplikasi trading terpercaya, cara trading, binomo com trading, trading quotex, apa itu trading forex, mt4 trading, robot trading forex, cara trading saham, forex trading adalah, belajar trading pemula, trading bitcoin, belajar trading binomo, fbs trading, robot trading yang terdaftar di ojk, octafx copy trading